Even so, 57% of households don’t actually have a budget. If you’ve wanted to get your finances in order, then printable budget templates, like these Google Sheets Budget Templates, are for you.

Sure, things like spreadsheets and budgeting apps are great. But, for me, there’s nothing better than taking pen to paper!

If you’re anything like me and prefer to make a budget the good old-fashioned way, then budget templates are for you.

With them, you can write down your income and expenses and stay on track with your budgeting goals.

Below, I have a list of the best free printable budget templates that you can use to achieve your financial goals.

FreeCash: Get paid up to $497.82 per offer – test apps, play games, and complete surveys for fast cash! Start earning today!

Earn Haus: Earn up to $25 per survey, plus get paid the same day via PayPal, Venmo, or check! Join Earn Haus now!

InboxDollars: Over $57 million paid to members for watching videos, shopping, and completing surveys. Claim your $5 bonus instantly when you join!

Product Report Card: Get paid to review products from home (payouts from $0.50 to $500)! Join for Free!

KashKick: Earn money watching videos, shopping, surfing the web, and more – PayPal payments are fast! Start earning with KashKick now!

Swagbucks: Watch videos, shop online, take surveys, and more – get $10 instantly when you sign up! Join now and start earning!

There’s something to suit everyone from simple templates to cute designs.

Now, to use these templates, you will need a few things including:

- A printer of course or access to one.

- Paper

- Your income including all income streams like your regular job and any side hustles you may have.

- Any savings you have.

- Your savings goals.

- A list of all your bills, expenses like what you spend on dining out, at the movies, etc., and debts.

Table of Contents

Free Budget Worksheets to Print Instantly

Here’s where you can find free budgeting templates….

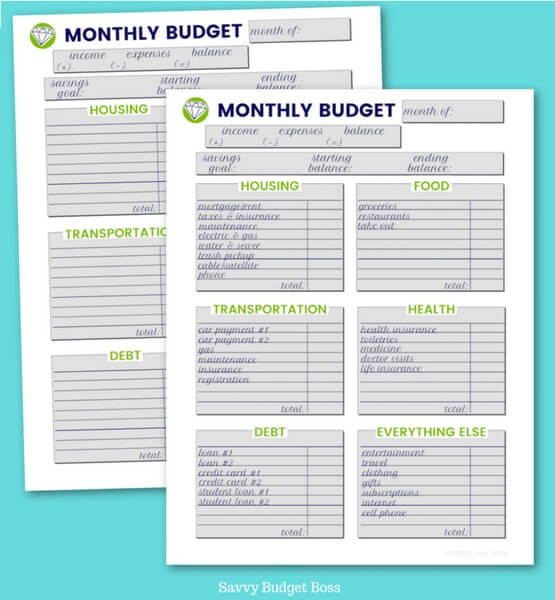

1. Printable Monthly Budget Template – Savvy Budget Boss

With the Savvy Budget Boss, you can get a monthly budgeting template. Just enter your email address to access it. With the budget template, there are sections where you can write down your income, expenses, and balance. And, there are sections for things like housing, transportation, debt, and food. It features a clean design, making it easy to use.

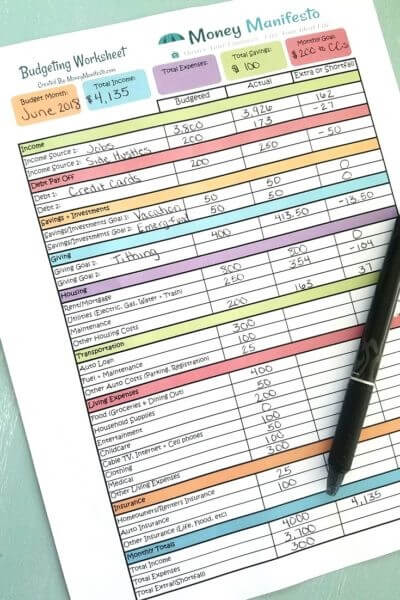

2. Budgeting Worksheet – Money Manifesto

This brightly colored budgeting worksheet from Money Manifesto makes budgeting a little more fun! At the top of the sheet, you can write down things like your total income, total savings, and total expenses.

Below that are sections for things like living expenses, housing, and insurance.

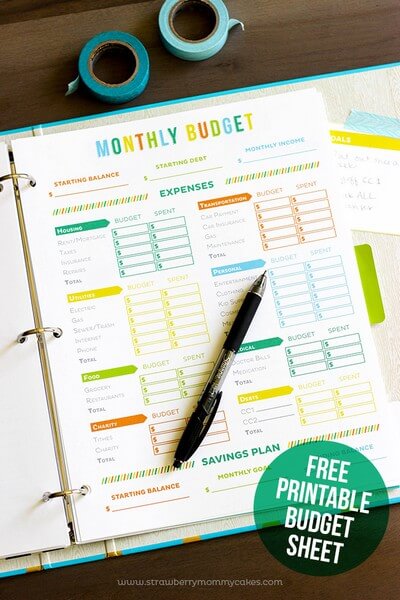

3. Printable Budget Sheet – Printable Crush

This printable budget sheet from Printable Crush features such a cute design and sunny colors. You can use it to write down your debts and income, and there are sections for things like food, utilities, charity, housing, and debts.

Advertisements

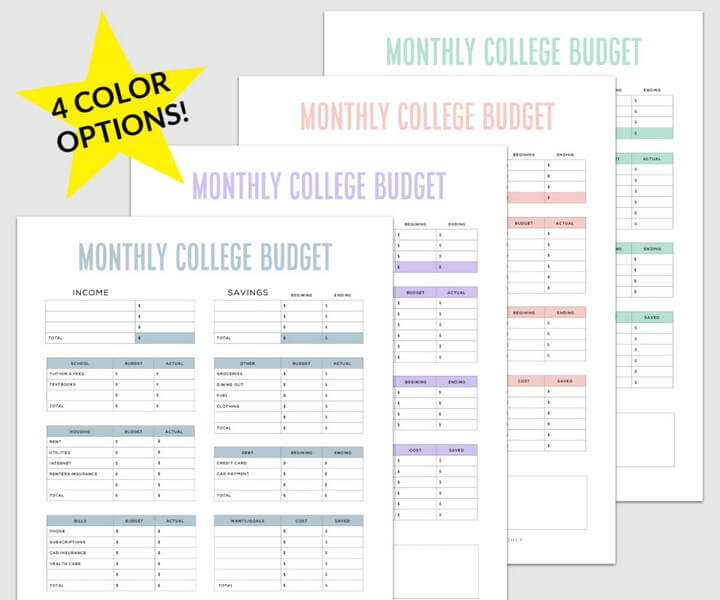

4. Monthly College Budget – College Life Made Easy

Are you a college student who’s looking to save money? For most college students, having a budget is key for keeping finances in order during what is an expensive period in their life. Thankfully, College Life Made Easy is offering a Monthly College Budget. And, it’s available in four different colors!

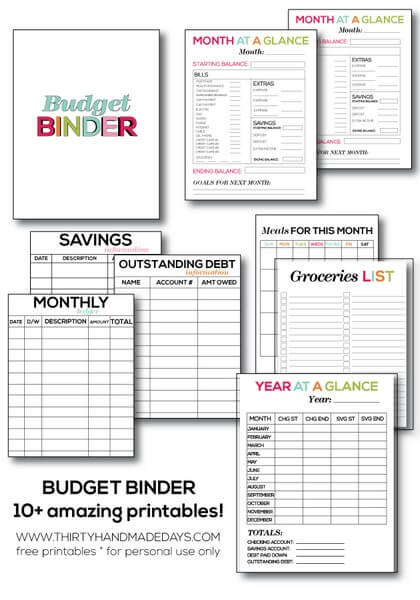

5. Printable Budget Binder – Thirty Handmade Days

What a whole budget binder? Then check out this printable budget binder from Thirty Handmade Days. It has a bunch of different pages like Month at a Glance, Savings, Groceries List, Year at a Glance, and Meals for this Month. The budget binder features a clean, simple design that makes budgeting easier.

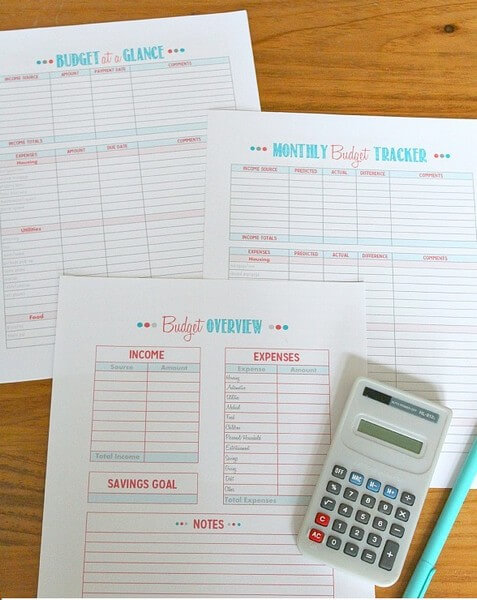

6. Family Binder Budgeting Printables – Clean and Scentsible

You can get Family Binder Budgeting Printables from Clean and Scenstible. It offers lots of different sheets, like Budget at a Glance, Monthly Budget Tracker, and Budget Overview.

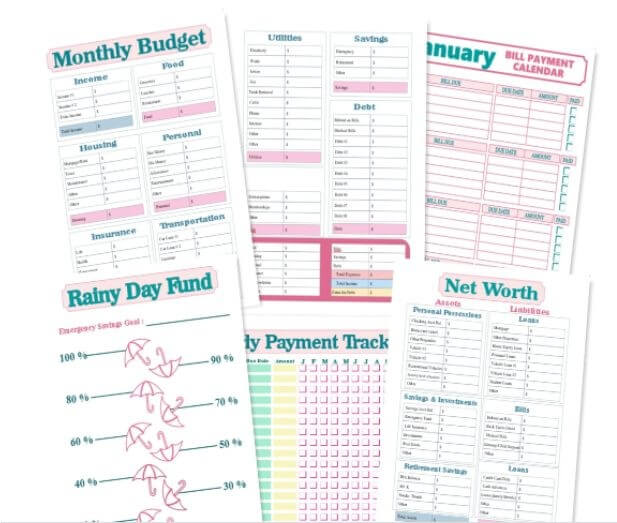

7. Printable Budget Templates – Money Minded Mom

You can get a wide range of budgeting templates from Money Minded Mom. There are lots of different sheets available, like Monthly Budget, Rainy Day Fund, and Net Worth. They feature a cute pink and blue design too.

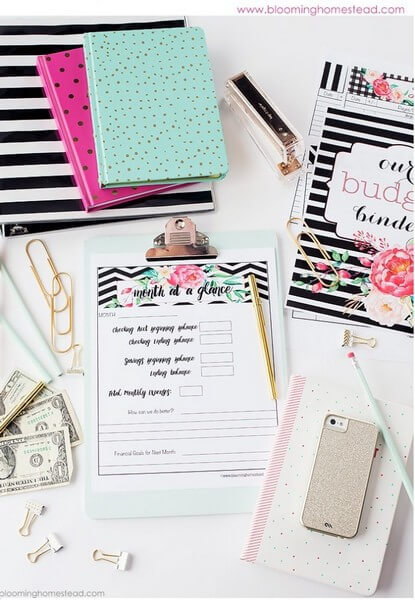

8. Budget Binder Printables – Blooming Homestead

If you’re looking for pretty templates, then check out these budget binder printables from Blooming Homestead. There are a few different pages available like a Weekly Ledger, Monthly Ledger, Month at a Glance, and Savings Ledger.

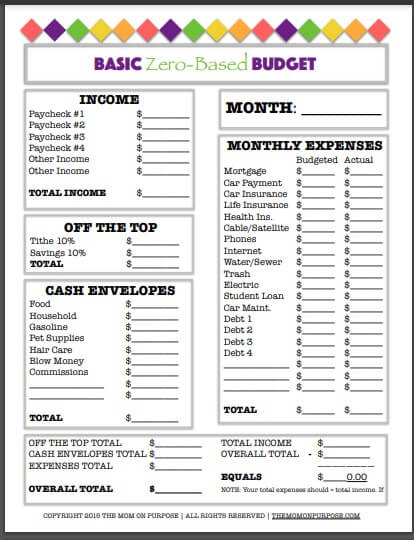

9. Basic Zero-Based Budget Worksheet – The Simply Organized Home

Zero-based budgeting, if you don’t already know, is a method of budgeting where your income minus your outgoings equals zero. This way, you know exactly where every dollar is going.

Let’s say, for example, you earn $2,000 a month. Your bills and expenses are $1,800. This would leave $200 over. You still need to tell that $200 where to go!.

So, you could put that $200 in your savings account, or use it to pay down debts, for example.

This is a popular budgeting method that’s recommended by people like Dave Ramsey who utilizes the method in his EveryDollar app.

If you’re interested in this type of budgeting, then check out this basic zero-based budget sheet from The Simply Organized Home. You can input all of your income and monthly expenses into it.

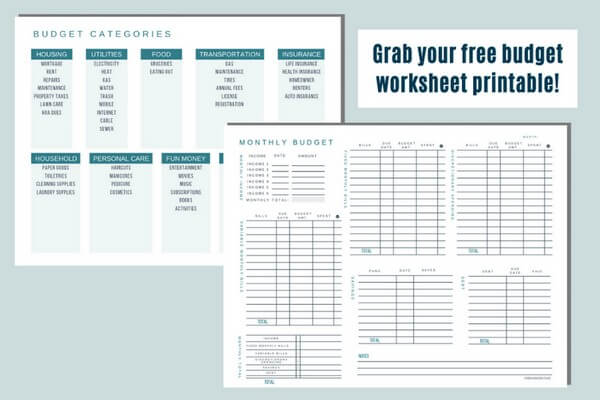

10. Blank Budget Worksheet Printable – Mom Managing Chaos

If you’re looking for a simple free printable budget sheet, then check out this worksheet from Mom Managing Chaos. It offers a monthly budget, and lots of budget categories, like Housing, Utilities, Insurance, Personal Care, and Fun Money.

11. Monthly Bill Payment Checklist – A Mom’s Take

If you’re looking for a simple way to keep track of your bills, then check out this Monthly Bill Payment Checklist from A Mom’s Take. With it, you can write down things like each bill/expense, and its due date.

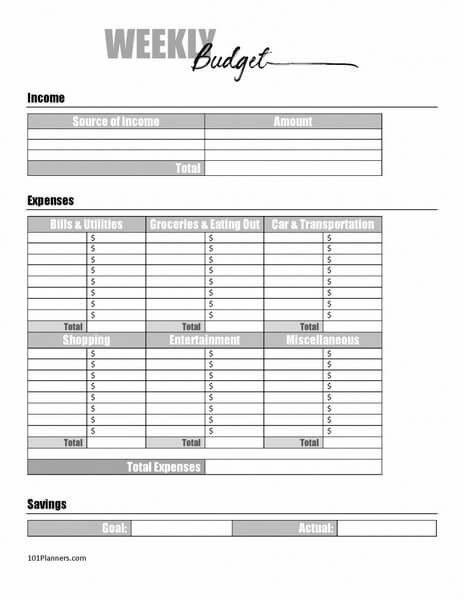

12. Weekly Budget Planner – 101Planners.com

101Planners.com has a Weekly Budget Planner that you can use to keep track of your income and expenses. You can keep track of things like Groceries & Eating Out, and Car & Transportation.

13. Free Monthly Budget Template Binder – Shining Mom

You can get a range of budget templates with this free budget template binder from the Shining Mom. It’s a great monthly budget planner!

14. Printable Debt Snowball Worksheet – A Cultivated Nest

The snowball method is a method for paying down your debts. If you don’t know what it is, basically, it’s the method of tackling smaller debts first.

So, you write down all of your debts in order from smallest to largest.

For example, let’s say that you had three debts. This is how you would order them with the snowball method:

- Credit Card One: $350

- Credit Card Two: $900

- Credit Card Three: $1,500

You then work on paying off the smallest debt first.

You still need to make the minimum payment on your balances for all of your debts. You just focus on paying more off of that first, smallest debt.

Once you have paid off the debt (the first one), so using the example above, that would be the $350 debt, you move onto the next debt. This would be the $900 debt for the example above.

You put the money that you were using to pay off the first debt on top of the minimum payment towards the second debt.

The whole thing snowballs – hence the name! This method of paying down debts can help you to keep your motivation high, since paying off a $350 debt is quicker than paying off a $1,500 debt – so it makes paying off your debts seem much more achievable. Once you have paid off the first debt, you will know that you are more than capable of paying off the rest!

If you are interested in using the snowball method to pay down your debts, then you should check out this free printable debt snowball worksheet from A Cultivated Nest. It’s a really simple worksheet that helps you to simplify your finances.

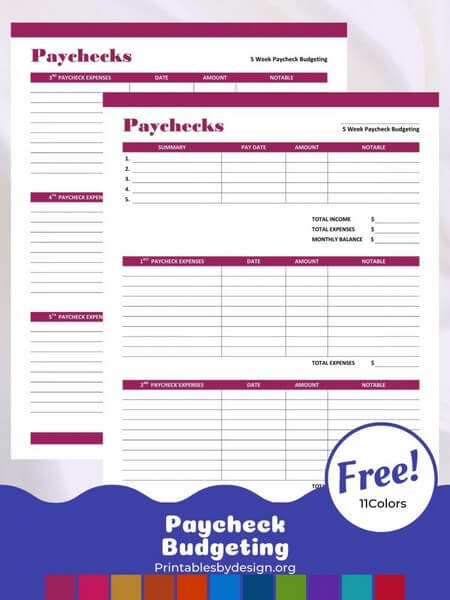

15. Paycheck Budgeting Printable – Printables by Design

Lots of people live paycheck to paycheck and would rather budget each time they get paid, rather than just once a month. So if the monthly paycheck budgets above don’t work for you, then try this paycheck budgeting printable from Printables by Design.

You can write down the amount for each paycheck you get and the expenses you have for each one. This is so handy if you get paid weekly, biweekly, or bimonthly. If you want to budget and you don’t get paid monthly, then paycheck budgeting could be for you.

Closing Thoughts

Having a budget is so important! It can help you pay off debts, save more money, and just keep better track of your finances.

And using budget worksheets and templates, make the process of tracking every single dollar you earn and spend much easier and faster. So give these awesome free printable budget templates a try. Print out a few today and manage your money better using a budget template.

Share your thoughts