If you’re searching for Pogo app reviews and wondering whether Pogo is a legit app, you’re probably looking for an easy way to save money while earning rewards on every purchase.

With Pogo, you get paid for sharing more data. It also claims to help you save money and earn rewards on every purchase while automatically finding more ways for you to save on your finances.

But is this real? Is the Pogo app legit and safe?

Let’s find out. In this comprehensive Pogo app review, I’ll cover how the app works and whether it’s worth your time.

Table of Contents

TL;DR: Is the Pogo App Worth It?

- ✅ Legit: Yes, it’s real. Backed by trusted tech (Plaid), with strong user reviews.

- 💰 Payout: 5,000 points = $5 via PayPal or Venmo

- 📱 Earning Methods: Shopping, surveys, linking accounts, receipt scanning, location rewards

- ⚠️ Drawback: Low earnings per action, requires sharing data

What is the Pogo App?

Pogo is an app for Android and iOS devices that allows you to earn and save money.

FreeCash: Get paid up to $497.82 per offer – test apps, play games, and complete surveys for fast cash! Start earning today!

Earn Haus: Earn up to $25 per survey, plus get paid the same day via PayPal, Venmo, or check! Join Earn Haus now!

InboxDollars: Over $57 million paid to members for watching videos, shopping, and completing surveys. Claim your $5 bonus instantly when you join!

Product Report Card: Get paid to review products from home (payouts from $0.50 to $500)! Join for Free!

KashKick: Earn money watching videos, shopping, surfing the web, and more – PayPal payments are fast! Start earning with KashKick now!

Swagbucks: Watch videos, shop online, take surveys, and more – get $10 instantly when you sign up! Join now and start earning!

The app claims that you can unlock the power of your data to earn and save on shopping, finances, and more. Pogo gives you points for shopping, taking surveys, and sharing your location data.

How Does the Pogo App Work?

Here’s how the Pogo app works:

Sign Up

The first step is to download the Pogo app (available for both Android and iOS devices). Visit the official site at JoinPogo.com to download the app for your iOS or Android device.

The app is only available in the United States, and since you need to connect a credit card, you’ll need to be at least 18 years old to use it.

It’s completely free to sign up, but you do need to link a bank account, which brings us to the next step.

Link Your Bank Account

Once you have downloaded the app, you will need to link your bank account to Pogo. This allows Pogo to track your transactions and start paying you for your data.

Pogo links your bank account through a third-party platform called Plaid for secure account linking. It’s also the same technology popular money apps like Venmo, SoFi, and Robinhood use.

Plaid uses advanced encryption and security protocols to protect your data. So, if you’re worried about privacy or sharing sensitive banking information, it’s worth reading about how Plaid keeps your data safe.

Plaid has connections with hundreds of banks and is continually adding new institutions and card connections. So, you should be able to find your bank or card to link to Plaid.

However, some smaller credit unions and local banks may not be part of the network. If you cannot find your bank, it means Plaid does not currently have a connection with that institution. Make sure to check back periodically, as Plaid is always expanding its network.

Advertisements

With the Pogo app, you essentially make money by sharing your transaction data. So, you’ll need to decide whether linking your card is worth it. If you want to earn rewards every time you shop, eat, or spend money in general, the app may be worth your time.

Earn Points

Once you’ve downloaded the app and connected your bank, you’ll be able to start earning points.

The Pogo App allows you to earn points in a variety of ways:

1. Shop

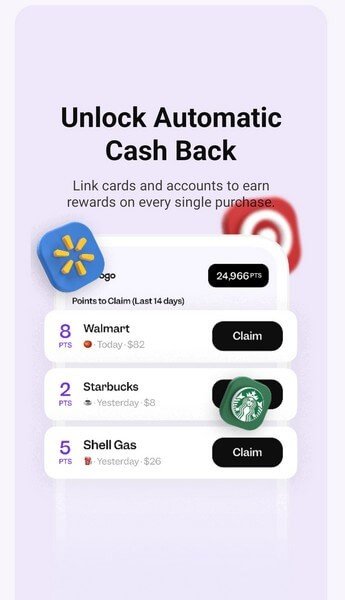

Once you’ve connected your bank account to Pogo, you can earn points for shopping. Each time you make a purchase, you’ll earn points without needing to upload photos of your receipts or manually enter transactions. It’s a completely passive income app!

Pogo awards points for every purchase shown on your credit card transaction list. Just connect your card, and you’ll earn rewards as long as the card is active and you’re making purchases.

You can expect to earn around 2 to 15 points per transaction. This is a totally passive way to earn rewards.

Unlike some reward apps that only pay you if you shop at specific partners or buy specific products, Pogo lets you earn points on every transaction, regardless of where you shop or what you purchase. There’s no need to worry about uploading photos of your receipts.

2. Link Your Third-Party Accounts

In addition to connecting your bank account, you can also link third-party accounts to earn more points.

For each account you link, you’ll receive 100 points upon linking it, and then 50 points for every transaction. Pogo allows you to link several third-party accounts for popular retailers such as:

- Amazon

- Instacart

- Publix

- Target

- Walmart

This is an easy way to maximize your earnings using the Pogo app.

3. Answer Surveys

You can earn even more with the Pogo app by answering surveys. There are a lot of GPT sites that offer surveys, like Swagbucks, which provide an easy way to make some extra money.

What’s good about the surveys on Pogo is that they actually pay more than transactions. Payments can range from 20 points to more than 1,000 points per survey.

Many of the surveys are short, taking only one question or a few minutes to complete, which is great if you’re busy. While surveys aren’t guaranteed, they offer a good way to boost your points and cash out faster, if they’re available.

4. Scan Your Receipts

The Pogo app also has a receipt scanning feature. If you want to get paid for your receipts, you can. The app mentions that the receipt scanning feature is new and is in the process of testing different point earnings. Most users earn 5 points per receipt, but some users may earn more.

You can scan up to 25 receipts per week. Receipts must be scanned within 14 days of the purchase date reflected on the receipt.

The benefit of the receipt scanning feature is that you can still scan a receipt even if you’ve already earned points for it with your linked account. This allows you to earn even more from your purchases.

5. Lower Your Bills

Pogo also helps you save money on your bills. You can use the app to lower your bills by comparing your monthly expenses against prices from other providers to potentially find a cheaper quote. This can help you save on things like insurance, utilities, and cell phone bills each month.

6. Get Location Rewards

You can also earn money with location rewards. Location rewards are brief ads that retailers and businesses share with you when you’re physically nearby one of their locations. To make money with this feature, you’ll need to share your location with Pogo so that it can locate reward opportunities in your area.

It’s sort of like Shopkick, where the app pays you for visiting some of its partners. If you’re out shopping anyway, this is a good way to maximize your rewards.

You can learn how to enroll in location rewards here.

Once you’ve started sharing your location, you’ll receive push notifications from Pogo alerting you to location reward opportunities in your area.

You can earn up to 1,000 points per month in location rewards.

Redeem Your Points for Cash

Once you have earned 5,000 points, you can cash out your earnings. 5,000 points is equal to $5.

You can redeem your earnings through PayPal or Venmo.

How Much Does Pogo Pay?

Here are the points you can earn on Pogo:

For purchases without linked retail accounts:

- Less than $10: 2 points

- $10 – $50: 4 points

- $50 – $100: 8 points

- More than $100: 15 points

For purchases with linked retail accounts:

- $10 – $50: 20 points

- $50 – $100: 35 points

- More than $100: 50 points

On Pogo, 1,000 points is equal to $1.

This means that you can earn anywhere from $0.002 to $0.015 for purchases without linked retail accounts.

For purchases with linked retail accounts, you can earn $0.02 to $0.05.

The amount of money you make with Pogo depends on how many purchases you make and how much you spend.

As mentioned above, there are also other ways to earn money, such as taking surveys, sharing location data, and scanning receipts. These can all boost your earnings.

Other Pogo Reward Reviews

Pogo is well-reviewed by its users online.

I also noticed how popular it is on Reddit, especially subreddits related to side hustles and making extra money online, in general.

It has a 4.3-star rating from users on the App Store and a 4.6-star rating from users on the Google Play Store.

Customers who use Pogo praise it for how easy it is to earn rewards, the fact that they don’t have to scan receipts to earn rewards, and the option to take surveys to earn even more.

One user on the App Store says:

- “I’ve only just downloaded this app earlier this week, but I am a seasoned ‘rewards’ app user. This app is extremely user-friendly and hands down one of the easiest rewards apps to use. All you have to do is connect your debit card(s) and bam you’re earning points, & earning points means you’re making free money.”

One user on the Google Play Store praises the app, saying:

- “All you need to do is connect the credit/debit cards you use, and voila, points are received once you open the app and click on the transaction. Most days, there is an option near your transactions that is a guaranteed, brief, few-question survey. There are additional surveys you may opt to fill out as well for extra points. It can be as easy and quick or as time-consuming as you wish.”

Pros & Cons of Pogo App

In this section, we’ll cover the pros and cons of the Pogo app so you can decide whether or not it’s for you.

Pros

Here are the pros of the Pogo app:

- Easy to earn with. Simply link your cards, spend as usual, and you’ll earn money.

- You don’t have to upload receipts to earn. Many apps that pay you to shop require you to upload photos of your receipts. Fetch Rewards and Ibotta, for example, both require you to upload receipts to earn money. With the Pogo app, you do not have to upload any receipts. This is great because uploading receipts can be time-consuming.

- You can boost your earnings with surveys. If you want to earn more money in addition to the cash you earn from your purchases, you can take some surveys.

- You can also earn by sharing your location data.

- You can cash out your points for cash through PayPal or Venmo.

- The cash-out threshold is low.

Cons

Here are the cons of the Pogo app:

- You have to be comfortable with selling and sharing your data. That’s not for everyone. So, if linking your cards and sharing your data doesn’t sound okay to you, then Pogo is likely not a good app for you.

- Low earning potential. While you only need $5 to cash out, that means you need to earn 5,000 points, and most transactions pay just $0.002 to $0.05, which means the earning potential is pretty low.

Pogo vs. Other Reward Apps

If you use other similar reward apps you may wonder how Pogo compares to them.

Here’s is a quick comparison table you can use to quickly check Pogo against your favorite rewards app.

App |

Earning Methods |

Payout Options |

Min. Payout |

User Ratings |

Best For… |

|---|---|---|---|---|---|

Pogo |

Shopping, surveys, receipt scanning, location rewards |

PayPal, Venmo |

5,000 points ($5) |

4.3★ (App Store), 4.6★ (Google Play) |

Hands-free passive earnings |

Swagbucks |

Surveys, watching videos, shopping, games |

PayPal, gift cards |

100–500 SB ($1–$5) |

4.4★ (App Store), 4.2★ (Google Play) |

Versatility & variety of earning methods |

Ibotta |

Grocery receipts, offers, in-store purchases |

PayPal, gift cards |

$20 |

4.8★ (App Store), 4.5★ (Google Play) |

In-store grocery shoppers |

Drop |

Shopping, linking cards, surveys |

Gift cards |

5,000 points ($5) |

4.6★ (App Store), 4.3★ (Google Play) |

Cashback on automatic card spending |

Frequently Asked Questions About the Pogo App

Is Pogo a safe app?

Yes, Pogo is absolutely safe to use. They actually use Plaid to link your bank accounts. plaid is the same secure technology major financial apps like Venmo and SoFi use.

How much can you actually make with Pogo?

Realistically, you can expect to make anywhere from $5 to $15 per month. This is what I gathered from personal experience and reading Pogo reviews on Reddit and other online forums.

How do you get your money from Pogo?

Once your account reaches 5,000 points (which equals $5), you can instantly cash out. You can link your PayPal or Venmo account and the money is typically transferred within minutes.

Is Pogo better than Fetch or Ibotta?

I personally think Pogo is better for earning passively since you don’t have to scan receipts or buy specific items to earn rewards. But Fetch and Ibotta have higher payouts so you can make more money if you don’t mind taking time to scan receipts and buy specific products.

Is Pogo Legit: Final Verdict

After testing Pogo and comparing it up against other similar money-making apps, I’d say, yes, the Pogo app is 100% legit and, for the right person, it’s absolutely worth it.

Like I always say, you’re not going to get rich with these kinds of apps. But that’s not the point of Pogo.

You are basically trading your anonymized shopping data and transaction history (what you buy, when and where you buy, etc.) for easy, passive cash.

If you’re okay with that deal, Pogo delivers exactly what it promises, a little extra money for doing practically nothing.

And as I mentioned you’re not going to get rich with Pogo since you only earn $0.002 to $0.05 per purchase. But you can definitely make a little extra cash using the app and all the ways it lets you earn.

Hopefully my personal review of Pogo reward app has answered any question you had about whether or not Pogo is legit. Good lcuk!

Share your thoughts