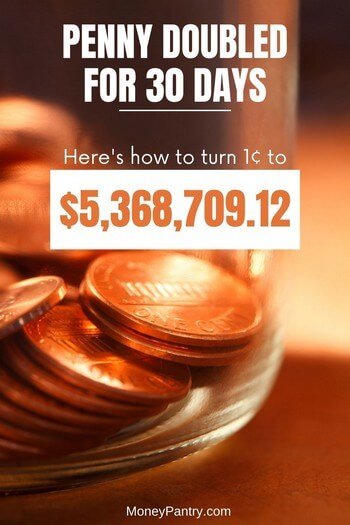

Would you rather have $1 million or a penny that doubles every day for thirty days?

Many people hear the phrase “a million dollars” and think it’s a lot of money. On the other hand, the word “penny” doesn’t exactly evoke thoughts of wealth.

But if you spend a little more time pondering the question, you’ll find that those pennies would actually be worth more than the million dollars!

In today’s post, I’ll explain why a penny doubled for 30 days results in more money than a million dollars.

Table of Contents

Why Choose a Penny Doubled for 30 Days Over $1 Million Right Now?

If you do the math, it becomes clear why a penny that doubles every day for 30 days is worth more than $1 million, or even $2 million, right now.

FreeCash: Get paid up to $497.82 per offer – test apps, play games, and complete surveys for fast cash! Start earning today!

Earn Haus: Earn up to $25 per survey, plus get paid the same day via PayPal, Venmo, or check! Join Earn Haus now!

InboxDollars: Over $57 million paid to members for watching videos, shopping, and completing surveys. Claim your $5 bonus instantly when you join!

Product Report Card: Get paid to review products from home (payouts from $0.50 to $500)! Join for Free!

KashKick: Earn money watching videos, shopping, surfing the web, and more – PayPal payments are fast! Start earning with KashKick now!

Swagbucks: Watch videos, shop online, take surveys, and more – get $10 instantly when you sign up! Join now and start earning!

This might seem surprising, as doubling a penny doesn’t initially appear to amount to much.

However, with the power of compound interest, that penny will eventually surpass the value of a million dollars.

At the end of those 30 days, that $0.01 will actually be worth $5,368,709.12.

Surprising, right?

This is an example of just how powerful the effects of compound interest can be.

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

So, a penny doubled every day for 30 days is not only worth more than $1 million, but it’s also worth more than $2 million, $3 million, and even $4 million! And it’s all thanks to compound interest.

The Power of Compound Interest

So, the answer to the question I posed at the beginning of the post is pretty clear. You’d choose the penny that doubles over the million dollars.

It’s important to note that the power of doubling is key here. The longer the doubling period, the more money you end up with.

For example, if you were to double a penny for only 25 days, you’d end up with $167,772.16. That’s a whole lot less than $5 million.

Advertisements

A penny doubling every day is a simple example of compound growth. It might be hard to believe that a penny can turn into millions because most things in life experience linear growth, also known as arithmetic growth. This is when something grows by a relatively constant amount per unit of time.

For instance, if you want to save $1,000 and decide to save $100 a month, after 10 months you’ll have saved $1,000. This is arithmetic growth because it increases by $100 each month.

Compound growth is different. It occurs when you invest that money, for example, in the stock market.

If we use the example of saving $100 a month again, but instead of saving it, you invest that money in the stock market, making an initial investment of $100 and then contributing $100 monthly, with an annual interest rate of 5%, here’s how it grows:

After the first year, you’d have $1,305 in savings.

After two years, you’d have $2,570.25.

After five years, you’d have $6,758.39.

If you were to save $100 a month without investing it, you’d simply accumulate $100 each month. After 5 years, you’d have saved $6,000.

With compound interest, however, that same $100 invested grows to $6,758.39.

You can use this calculator to see how compound interest works when you invest different amounts.

This demonstrates the power of compound interest.

Penny Doubled for 30 Days Chart

If you want to see what a penny doubling for 30 days looks like, check out the chart below. It shows how much money you’ll have on each day.

As you can see, the money doesn’t even reach the $100 mark until day 15! This illustrates how the longer the money doubles, the more you accumulate.

Here’s a chart showing the growth of a penny that doubles for 30 days.

Closing Thoughts

The key here is to invest. Compound interest allows you to turn a seemingly small amount of money into a large sum. The earlier you invest, the better, as it results in greater returns over time.

Although 5% interest might not seem like a lot at first, after 10 years, you’ll start seeing substantial returns. After 30 years, you could accumulate a significant amount, which is excellent for retirement.

For example, if you make an initial investment of $100 and contribute $200 monthly for 25 years with an interest rate of 10%, you’d end up with $237,116.41.

Some people worry about investing due to the risk of losing money. It’s true that the stock market fluctuates; the market can go up or down, sometimes significantly.

However, over a long time period, the market tends to rise. While there are periods when it’s down, if you’re investing for decades, you’re likely to see positive returns. Think of investing as a long-term process that will reward you in the future.

With compound interest, you let your money work for you, turning a seemingly small amount, like a penny, into millions of dollars.

If you’re unsure how to get started with investing, there are plenty of great resources online.

Here are a few articles to get you started:

- How To Invest In Stocks (Forbes)

- How to Invest in Stocks: A Beginner’s Guide (Investopedia)

- How to Invest in Stocks for Beginners (U.S. News)

As you can see, a penny that doubles for 30 days is a better option than a million dollars, all thanks to compound growth. So, if you can, consider investing your money now, as it will pay off in the future.

Wow, mind blown! 💥

Who knew a penny could outshine a million? Compound interest for the win! Ready to invest for that sweet long-term growth?